SBI has proposed merger of its five associate banks and newly created Bharatiya Mahila Bank (BMB) with itself.

Friday 20th of May 2016

Sharing is caring

The country’s largest lender, State Bank of India (SBI) has proposed merger of its five associate banks and newly created Bharatiya Mahila Bank (BMB) with itself and sought government’s approval for the same — a major bid to consolidate the public sector banking space.

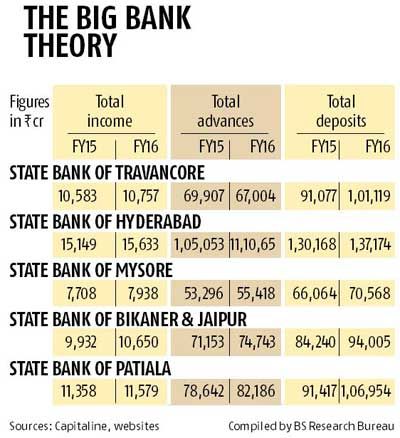

SBI is seeking “in principle sanction” of the Central Government to enter into negotiation with the subsidiary banks (State Bank of Bikaner and Jaipur, State Bank of Hyderabad, State Bank of Mysore, State Bank of Patiala and State Bank of Travancore) and Bharatiya Mahila Bank Limited to acquire their businesses, including assets and liabilities.

No decision has been taken at this stage approving one or more of the aforesaid acquisitions and the same will be taken by the bank’s board upon evaluating all the relevant considerations.

Commenting on the proposal, SBI Chairperson Arundhati Bhattachraya said with the merger the balancesheet size will soar to Rs 37 lakh crore from Rs 28 lakh crore currently. Meanwhile, a section of employee unions have registered protest against any such move and threatened to go on a strike if such a move is approved by the SBI and the government.

5 subsidiary banks are: (i) State Bank of Bikaner and Jaipur, (ii) State Bank of Hyderabad, (iii) State Bank of Mysore, (iv) State Bank of Patiala and (v) State Bank of Travancore.

Besides, the boards of the subsidiary banks and the SBI also met individually in Mumbai to begin merger talks to acquire the businesses including assets and liabilities.

Important Points

- The merged entity will increase SBI’s market share from 17 per cent to 22.5-23 per cent the country with total business of over Rs. 35 lakh crore.

- It will have one-fourth of the deposit and loan market in the country and SBI’s staff strength will increase by 35-49 per cent.

- The merged entity will also increase branch network by 6,000. At present, SBI alone has more than 15,000 branches in the country.

- SBI first merged State Bank of Saurashtra with itself in 2008. Two years later, State Bank of Indore was merged.

- The government recently set up the Bank Board Bureau (BBB) to look into the issues including consolidation in public sector banking space.

- The BBB headed by former CAG Vinod Rai has conducted interview for appointments of Managing Directors of some of the banks where posts will be falling vacant during the current fiscal.

Background

The merger move comes after the Union Government had announced a road map for bank consolidation during the 2016-17 Union Budget. This was seen as necessary to meet the huge infrastructure financing needs of the country. It also seeks to feature Indian Bank in the top 50 banks of the world in terms of size as no bank in the country features in it.

Sharing is caring

Related Post

India and Nepal Signed Seven Agreements

Renowned Telangana poet passes away, Guda Anjaiah

Government approves Guidelines on service charge

The new Intellectual Property Policy released by the Finance Minister

IMF, OECD, UN and World Bank join forces to tackle tax evasion..

Madhya Pradesh becomes First State to Shift Financial Year to Jan-Dec Format