Loanable funds theory of Interest was developed by:

Wicksell

Robert San

Ruskin

J.B.Say

Correct Answer :

A. Wicksell

Loanable funds theory of Interest? According to the Loanable Funds Theory of Interest, the rate of interest is calculated on the basis of demand and supply of loanable funds present in the capital market. The concept formulated by Knut Wicksell, the well-known Swedish economist, is among the most important economic theories. The Loanable Funds Theory of Interest advocates that both savings and investments are responsible for the determination of the rates of interest in the long run. On the other hand, short-term interest rates are calculated on the basis of the financial conditions of a particular economy. The determination of the interest rates in case of the Loanable Funds Theory of the Rate of Interest, depends essentially on the availability of loan amounts. The availability of such loan amounts is based on certain factors like the net increase in currency deposits, the amount of savings made, willingness to enhance cash balances and opportunities for the formation of fresh capitals.

Related Questions

Of the following commodities, which has the lowest price-elasticity of demand?

Car

Salt

Tea

House

The difference between accounting profits and economic profits is:

Implicit costs

Explicit costs

Fixed costs

Variable costs

Monopolistic firm can fix:

Both price and output

Either price or output

Neither price nor output

None of the above

Perfect competition assumes:

All buyers and sellers have perfect knowledge of the market

Freedom of entry of firms into the industry

Homogeneous product

All of the above

Production function shows:

Technical relationship between inputs and output

Profitability production

Relation between MR and MC

Relation between AR and AC

For monopolistic competitive firm:

P=AR and P>MR

P

P=MC and MC=AC

None of the above

Which of the following conditions is met in the long-run equilibrium in monopolistic competition, where the firm is earning only normal profits?

MC =AC and P

MC = AC and P=MR

P =MC and P

MC=MR and P =AR= ATC

Which of the following is not an explicit cost of production?

Wage of self-employed proprietor

Depreciation on machinery

Returns on owned capital

Cost of raw materials

In second degree price discrimination, monopolist takes away :

All of the consumer surplus

All of the producer surplus

Some part of the consumer surplus

None of them

Karl Marx:

Led the Russian Revolution

Provided the theoretical basis for socialism(communism)

Developed his theory in response to the Great Depression of the 1930s

None of the above

With which of the following concepts is the name of J.M.Keynes particularly associated?

Marginal propensity to consume

Marginal propensity to save

Liquidity preference

All of the above

Discriminating monopoly implies that the monopolist charges different prices for his commodity:

From different groups of consumers

For different uses

At different places

Any of the above

The word ECONOMICS is derived from the Greek terms meanings:

Political economy

Household Management

Production and consumption

Financial Accounting

The firms in non-cooperative games:

Enforce contracts

Make contracts

Make negotiations

Do not make negotiations

The largest possible loss that a firm will make in the short run is:

Zero

Its total fixed cost

Its total variable cost

Equal to one

Each firm in cournot model assumes that its competitor will:

change its output

not change its output

change its price

not change its price

Law of variable proportions is based on the assumption of:

Short period of time

Long period of time

Timeless production relationship

All of the above

According to Diamond Water Paradox diamonds are more expensive than water because:

They yield higher total utility

They yield higher marginal utility

They are more useful

None of the above

When the output of a firm is increasing, its average fixed cost:

Declines continuously

Remains constant

Rises continuously

Declines and then rises

In case of monopoly, both AR and MR fall, but MR falls:

Double to that of AR

1/2 to that of AR

2/3 to that of AR

Four times to that of AR

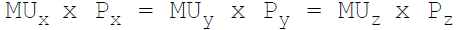

The Law of Equi-Marginal Utility states:

per income rupee

per income rupee

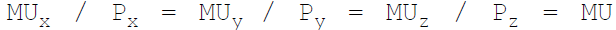

The least cost combination of factors x , y and z will generally be the point at which:

Price of x = Price of z Price of y Price of x

MP of x = MP of y Price of x Price of x

MP of x = MP of y = MP of z Price of x Price of y Price of z

MP of x = MP of y = MP of z

At the point where a straight line demand curve meets the quantity axis (x-axis), elasticity of demand is:

Equal to zero

Equal to one

Equal to infinite

More than one

From the resource allocation view point, perfect competition is preferable because:

The firms operate at excess capacity levels

There is a whole variety of output produced

There is no restriction on entry and exit of firms

There is no idle capacity

If price exceeds AVC but in smaller than AC at the best level of output, the firm is:

Making a profit

Incurring a loss but should continue to produce in the short-run

Incurring a loss and should stop producing immediately

Making a normal profit

A market demand curve presumes that:

All consumers are alike

Incomes of all consumers is the same

Tastes of all consumers are the same

Consumers differ in taste, incomes and other matters

For the given production function, technical efficiency is defined as:

Sets of points relating production function that maximizes output given input (labor) i.e. Q = f(L, K)

Sets of points relating production function that produces less output than possible for a given set of input (labor) i.e. Q < f(L, K)

Use of imported technology

None of the above

An increase in the supply of a commodity is caused by:

Improvements in its technology

Fall in the prices of other commodities

Fall in the prices of factors of production

All of the above

The games which played by players again and again are called:

Repeated games

Cooperative games

Non-cooperative games

Constant games

Which cost increases continuously with the increase in production?

Average cost

Marginal cost

Fixed cost

Variable cost