The output where TC = TR & AC = AR:

Break-even point

Load point

Shut-down point

Revenue cost point

Correct Answer :

A. Break-even point

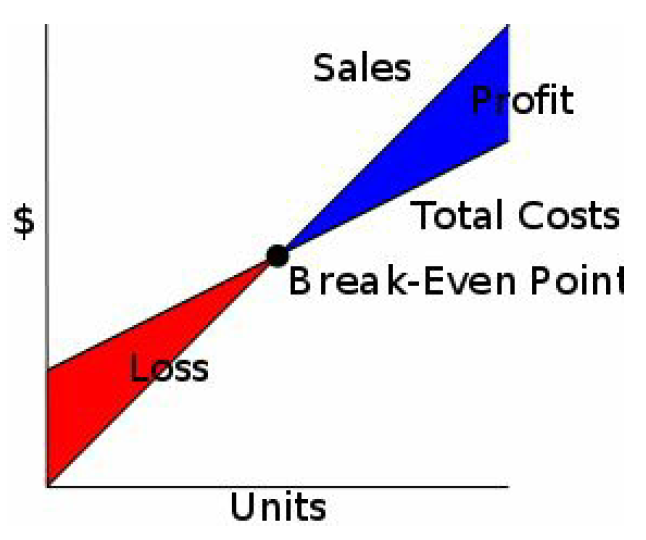

Break-even point?In economics & business, specifically cost accounting, the breakeven point (BEP) is the point at which cost or expenses and revenue are equal: there is no net loss or gain, and one has broken even. A profit or a loss has not been made, although opportunity costs have been paid, and capital has received the riskadjusted, expected return.

Break even point is the level of sales at which profit is zero. According to this definition, at break even point sales are equal to fixed cost plus variable cost (b/c total cost is the sum of fixed cost and variable cost). This concept is further explained by the the following equation: [Break even sales = fixed cost + variable cost] The main advantages of break even point analysis is that it explains the relationship between cost, production, volume and returns. It can be extended to show how changes in fixed cost, variable cost, commodity prices, revenues will effect profit levels and break even points. Break even analysis is most useful when used with partial budgeting, capital budgeting techniques. The major benefits to use break even analysis is that it indicates the lowest amount of business activity necessary to prevent losses. Break-even price analysis calculates the price necessary at a given level of production to cover all costs. Break-even Point calculation � Calculation of the BEP can be done using the following formula:

BEP = TFC / (SUP - VCUP)

where:

BEP = break-even point (units of production)

TFC = total fixed costs,

VCUP = variable costs per unit of production,

SUP = selling price per unit of production. }

Related Questions

The Hicksian demand curve includes:

Substitution effect

Income effect

Both substitution and income effect

None of them

When elasticity of demand is one (e=1), then following the formula MR=P[1-1/e], the MR will:

Positive

Negative

Zero

None of the above

The production techniques are technically efficient:

Bellow the lower ridge line

Above the upper ridge line

Between the two ridge lines

On the upper ridge line

A dominant strategy can best be described as:

A strategy taken by a dominant firm

A strategy taken by a firm in order to dominate its rivals

A strategy that is optimal for a player no matter an opponent does

A strategy that leaves every player in a game better off

The equilibrium of a firm is determined by the equality of MC and MR in only:

Under perfect competition

Under monopoly

Under imperfect competition

Under all the above market forms

With the expansion of output, the short run average cost curve, beyond a point, starts rising because:

Average fixed cost increases sharply

More production yields lower per unit price

The law of variable proportions applies to short run production

Sales expenses become much larger

An inferior good/ commodity is inferior for:

Every consumer

Most consumers

All consumers

Some consumers and not for others

The firm in cournot model:

face costs

face taxes

donot face taxes

donot face costs

The law of Diminishing Marginal Utility implies that the marginal utility of a good decreases as:

It gets more expensive

A household consumes more of it

Preference changes

A households income goes up

The demand curve in monopolistic competition (also in kinked demand curve model), which shows the share of a firm in market is called:

Relative demand curve

Proportional demand curve

Productive demand curve

Differential demand curve

The total utility (TU) curve is:

Concave to X-axis

Convex to X-axis

Concave to Y-axis

Convex to Y-axis

All money costs can be regarded as:

Social costs

Opportunity costs

Explicit costs

Implicit costs

In cournot model, at equuilibrium when MC = MR, the elasticity of demand is:

equal to one

zero

negative

equal to 2

If the demand for good is less elastic and government levied a tax per unit of output, the price per unit for the firm would:

Rise by the amount of the tax

Rise by more than the amount of the tax

Rise by less than the amount of the tax

Remain the same

In cournot model, each firm expects a reaction from his rival but the expected reaction is not:

important

materialized

accepted

rejected

The isoquant which are generated by CES (constant elasticity of substitution) production function are always:

Positively sloped

Negatively sloped

Concave to the origin

None of the above

The demand of the luxuries is:

More elastic

Less elastic

Unit elastic

Zero elastic

Which of the following is not a characteristic of a perfectly competitive market?

There is perfect information about prices

All participants in the market are small relative to the size of the overall market

There are many buyers and sellers

Buyers and sellers do not know each other

A monopolist has control over the price he charges for his product. He will be able to maximize his profit by:

Lowering the price, if the demand curve is elastic

Lowering the price, if the demand curve is inelastic

Rising the price, if the demand curve is elastic

None of the above is applicable

The central problem of economics is:

Declining productivity

Increasing consumption

Limited material wants

Limited resources and unlimited wants

Normally when price per unit of time falls:

Quantity demanded increases

Quantity demanded decreases

Quantity demanded remains constant

Quantity demanded becomes zero

Price discrimination is possible:

When elasticities of demand in different markets are the same at the ruling price

When elasticities of demand are different in different markets at the ruling price

When elasticities cannot be known

When elasticities of demands are zero in different markets at the rulling price

For a commodity giving large consumers surplus, the demand will be:

Less elastic

More elastic

Unit elastic

Zero elastic

Price discrimination is undertaken with the aim of:

Increasing sales and maximizing profits

Reducing sales and raising prices

Minimizing cost and maximizing revenue

Serving the markets without earning profits

Slope of a demand curve is:

Not relevant to elasticity

The only factor determining elasticity

Only one of the factors influencing elasticity

None of the above

In Nash Equilibrium:

Each player has a dominant strategy

No players have a dominant strategy

At least one player has a dominant strategy

Players may or may not have dominant strategies

In monopolistic competition, the cost curves of all firms are:

Uniform

Different

Dependent

Independent

The modern cost curves are based upon the idea of:

Fixed capacity

Specific capacity

Excess capacity

Reserve capacity

The necessary condition of firms equilibrium requires:

dR/dQ + dC/dQ = 0

dR/dQ - dC/dQ = 0

dC/dQ - dR/dQ = 0

dR/dQ > dC/dQ > 0

For the equilibrium of the firm and the industry in the short period in a competitive market, the condition is:

P = AC

P = MC

AC = MC

MC = TR