To calculate the Economic Profit we must deduct which of the following cost from our total revenues?

Opportunity cost

Direct cost

Rent cost

Wage cost

Correct Answer :

A. Opportunity cost

Economic Profit ? Economic profit is the difference b/w the revenue received from the sale of an output and the opportunity cost of the inputs used. In calculating economic profit, opportunity costs are deducted from revenues earned. Opportunity costs also called implicit costs are the alternative returns foregone by using the chosen inputs. For example, say you invest Rs.100000 to start a business, and in that year you earn Rs.120000 in profits. Your accounting profit would be 120000 100000 = 20000. However, say that same year you could have earned an income of Rs.15000 had you been employed . Therefore, you have an economic profit of 120000-100000-18000 = 2000. Accounting Profit? A firms total earnings, calculated according to Generally Accepted Accounting Principles (GAAP), and includes the explicit costs of doing business, such as depreciation, interest and taxes. Accounting Profit = TR- Explicit Cost Economic Profit = TR- Explicit Cost- Implicit Cost Implicit Cost ?Any cost that result from using an asset instead of renting, selling, or lending it. It is also called opportunity cost. Explicit Cost ?Is a direct payment made to others in the course of running business, such as wage, rent and material cost etc. Economic profit is smaller than the accounting profit. Economists measure a firms economic profit while accountants measure the accounting profit.}

Related Questions

A firm can never produce in the middle area of input space, in case of:

Concave isoquant

Convex isoquant

Constant isoquant

None of the above

Technological Progress (Invention) can be defined as:

Technological progress shifts the production function by allowing the firm to achieve more output from a given combination of inputs (or the same output with fewer inputs)

Technological progress shifts the production function by allowing the firm to achieve less output from a given combination of inputs (or the same output with more inputs)

Technological progress shifts the import function to the right

None of the above

If demand increased and supply decreased then:

Quantity exchanged might rise or fall and price would rise

Quantity exchanged would rise and price would fall

Quantity exchanged would rise and price might rise or fall

Both quantities exchanged and price would rise

In short run:

Labor is variable

Labor is fixed

Capital is variable

None of the above

If the factors have to be employed in a fixed ratio, then the elasticity of substitution under Leontief technology is:

One

Zero

Two

Five

Which form of market structure is characterized by interdependence in decision-making as between the different competing firms?

Oligopoly

Perfect competition

Imperfect competition

None of the above

The budget line is described by each of the following except:

Prices of products are assumed to be fixed

The consumer need not to spend all his income

Consumer income is assumed to be fixed

The slope represents relative prices

The production process is:

Consuming goods and services

Transforming inputs into outputs

Wasting goods and services

Buying goods and services

Total utility and price are:

Directly related

Unrelated

Closely related

Negatively related

In substitution effect and income effect:

The substitution effect is more certain

The income effect is more certain

The substitution effect is uncertain

The income effect is always positive

In the immediate run:

Supply curves are inelastic

Supply curves are perfectly elastic

Demand curves are elastic

Supply curves are elastic

The price consumption curve (PCC) for commodity X is the locus of points of consumer equilibrium resulting when:

The price of only Y is varied

The price of only X is varied

The prices of both Y and X are varied

None of the above

In cournot model, at equuilibrium when MC = MR, the elasticity of demand is:

equal to one

zero

negative

equal to 2

In case of short-run, the supply curve of an industry is the horizontal summation of:

Marginal cost curves

Average cost curves

Total cost curves

None of the above

The slope of indifference curve shows:

Income level

Satisfaction level

Marginal rate of substitution

Demand level

The proportionality rule in production requires that the ratios of MP and factor prices are:

Doubled

Equalized

Not equalized

None of the above

Under monopolistic competition, the firms compete alongwith:

Supreme powers

Discretionary powers

Low powers

None of the above

The low cost price leader will charge:

higher prices

zero prices

lower prices

specific prices

If both demand and supply were to increase then:

Quantity exchanged would fall and price would rise

Quantity exchanged and price would both fall

Quantity exchanged would rise and price might rise or fall

Quantity exchanged and price would both rise

The feasible part of the demand curve for the monopolist who is charging high price will be:

The elastic part of a demand curve

The inelastic part of a demand curve

The constant elastic part of the demand curve

None of the above

Price discrimination occurs when:

Different prices are charged to different consumers for homogenous products

Same prices are charged for differentiated products

Different prices are charged for homogenous goods for successive units to the same customer

Any of the above condition is present

Extension (expansion) and contraction of demand are result of:

Change in consumers income

Change in consumers tastes

Change in price

None of the above

Identify the factor, which generally keeps the price elasticity of demand for a commodity low:

Variety of uses for that commodity

Its low price

Close substitutes for that commodity

High proportion of the consumers income spent on it

The cournot model is a model of:

Instable equilibrium

Stable equilibrium

Constant equilibrium

Fluctuating equilibrium

In monopoly, the relationship between average revenue and marginal revenue curves is as follows:

Average revenue curve lies above the marginal revenue curve

Average revenue curve coincides with the marginal revenue curve

Average revenue curve lies below the marginal revenue curve

Average revenue curve is parallel to the marginal revenue curve

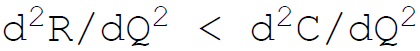

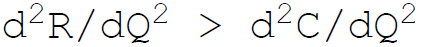

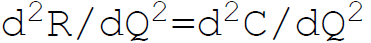

The sufficient condition of firms equilibrium requires:

none of the above

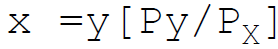

The marshallian indirect utility function in the form of equation is:

x =a-bp

x =b-ap

x = f(P)

In dominant strategies I am doing the best, I can no matter:

What you do

What you are doing

What you not do

None of them

The indifference curve technique:

Helps in separating the income effect and the substitution effect

Does not help in separating the two effects

Mixed up the two effects

None of the above

In Edgeworth model, prices oscillate between:

Firms and industry price

Monopoly and duopoly price

Competitive and monopoly price

None of the above